Archive: Flexible Spending Accounts 2025

NBS Information

- Employees should select their benefit amount to reflect 24 pay periods.

- The medical flexible spending limit is $3,400.

- The dependent care flexible spending limit depends on your federal tax filing status: $7,500 if you are married and filing a joint return or if you are a single parent, or $3,250 if you are married but filing separately.

- The commuter benefit arrangement limit for transportation is $340/month.

- The commuter benefit arrangement limit for parking is $340/month.

- Employees are able to roll over $680 from 2026 to 2027, which will likely increase for the 2027 to 2028 plan years.

Documents

- Summary Plan Description

- Flexible Spending Account Information

- Flexible Spending Account FAQs

- Dependent Care Flexible Spending Account Information

- Healthcare Expense Account Sample Expenses

- Limited Flexible Spending

- Commuter Benefits

- NBS Web Portal First Time Login

- NBS Mobile App Information

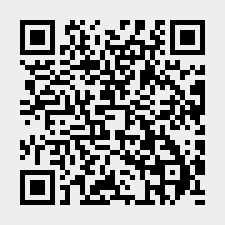

NBS Mobile App

Important Information

Employer ID – NBS468933

Employee ID – Social Security Number (without slashes or hyphens)

Be a Good Consumer

- Submit all documentation by the end of March for the previous year.

- Using flexible spending will save you $20–25 dollars for each $100 dollar benefit.